Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2024-12-04

Business Banking

published

4 minutes

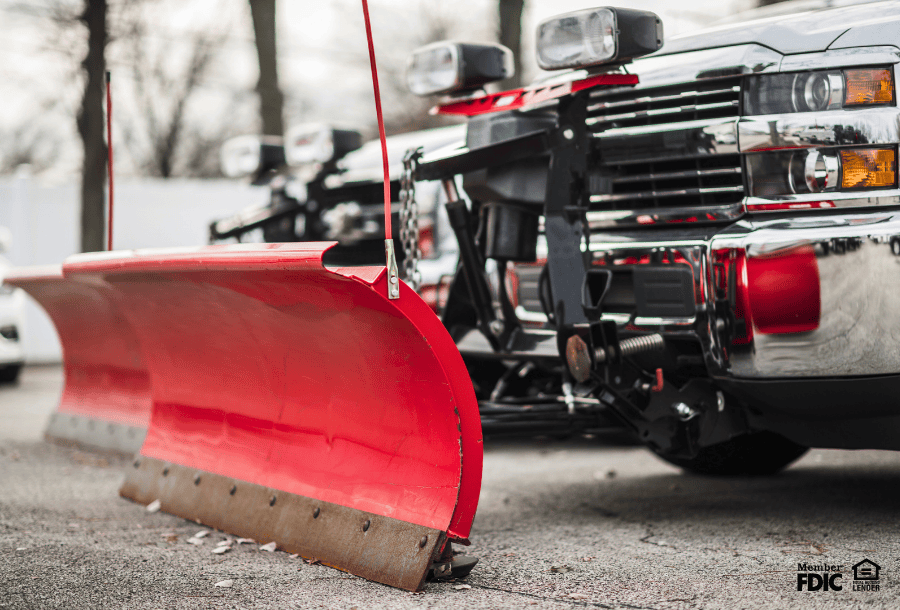

Top Business Loans for Snow Removal and Deicing Companies

-

-

When winter arrives, snow removal and ice management businesses become the unsung heroes of the season. Having clear roads, parking lots, and driveways keeps people safe and helps our daily life run smoothly. But as the winter services industry evolves, these companies face new challenges that call for updated technology and financial support. Business term loans can help these companies stay competitive and grow in a fast-changing market. Here are the key trends in the snow removal industry and how business term loans can support expansion and innovation.

Recent Trends in Snow Removal and Ice Management

The winter services industry has come a long way from traditional methods like shovels and salt spreaders. Today, it's a tech-driven sector that uses advanced equipment and cutting-edge technology. Here are the key trends:

- Regional Priorities:

- The Northeast leads with innovation and cutting-edge technologies.

- The South represents a growing market with increasing demand.

- The Midwest focuses on efficiency and staying competitive through new tech.

- The West Coast emphasizes green initiatives and sustainable practices.

- Sustainability Efforts: Companies are adopting eco-friendly materials, investing in electric vehicles, and utilizing digital tools to reduce their environmental impact.

- Tech Advancements: GPS, AI, and automation are transforming operations, while smart technology is driving greater efficiency and precision.

- Climate Change Impact: Changing snowfall patterns require businesses to adapt their strategies and uncover new opportunities.

- Labor and Supply Challenges: Businesses are tackling labor shortages and dealing with tighter salt supplies, pushing for creative solutions to stay ahead.

To explore these industry trends in more depth, read our previous article: Trends in the Snow & Ice Management Industry for Business Financing.

What is a Business Term Loan?

A business term loan is a financial solution where companies borrow a lump sum of money and repay it over time with fixed interest rates. It is similar to a personal loan but for business purposes. Term loans give companies the capital they need to grow, buy equipment, and keep cash flow steady.

Term loans for businesses are a great option for seasonal ups and downs, especially for companies in the snow and ice management industry. With fixed repayment schedules and manageable interest rates, these loans offer financial stability and predictability, so you can focus on running your business. Plus, business term loans are flexible, letting you use the funds in ways that fit your company’s needs and goals.

How Snow Removal and Deicing Services Use Business Term Loans

Companies in the winter services industry face new challenges that call for smart investments to stay competitive. Business term loans can help businesses take advantage of growth opportunities and improve efficiency in a changing industry. Here’s how:

1. Invest in New Technology and Equipment

Investing in the latest snow removal tools and vehicles is key to staying competitive in the industry. Business term loans can provide the capital for buying advanced equipment and integrating AI and GPS technology into your operations. These smart investments improve efficiency, service quality, and also set your company up for success.

2. Expand Service Offerings

Expanding into new regions or offering additional services can open up great opportunities and create new revenue streams. Business term loans help finance these expansions and let snow and ice management companies create new services to meet customer needs. By diversifying what they offer, companies can reach a wider audience and grow their share of the market. (See “Growth Projections & Regional Demands” in our previous article).

3. Improve Sustainability Practices

Sustainability is becoming more important to both customers and regulators. Business term loans give snow removal and deicing companies the chance to invest in eco-friendly equipment and materials, helping them align with green initiatives. These efforts attract environmentally conscious clients and contribute to a greener future.

4. Manage Cash Flow During Off-Seasons

Snow removal and ice management is a seasonal business, with demand changing throughout the year. Business term loans offer the financial support needed to keep cash flow steady during quieter times. This helps companies provide consistent payments to staff and suppliers, making sure they remain financially stable and prepared for the next winter season.

5. Address Labor Shortages

To tackle labor shortages, snow removal companies can use business term loans to fund training programs and offer competitive salaries and benefits. By investing in their workforce, businesses attract and retain skilled employees, ensuring they have the talent needed to deliver high-quality services.

Apply for a Business Term Loan with Academy Bank

The winter services industry is changing fast, thanks to new technologies, sustainability efforts, and the impacts of climate change. To succeed in this landscape, companies must embrace these trends and focus on growth. Business term loans offer the financial support for overcoming challenges, seizing opportunities, and building a strong, successful enterprise.

For snow removal and deicing companies looking to stay ahead, partnering with Academy Bank can make all the difference. Our business term loans offer:

- Competitive interest rates to save you money

- Flexible repayment terms tailored to your seasonal needs

- Opportunity to strengthen your credit while growing your business

Learn about the benefits of business term loans and take the next step toward reaching your business goals. Connect with a business banker or check out Academy Bank's website to learn more about our business term loans!

Looking for other business lending options? Compare business loans today.

Member FDIC

All loans and lines of credit are subject to credit approval and require automatic payment deduction from an Academy Bank business checking account. Origination and annual fees may apply. Terms, conditions, and loan product eligibility applies.