Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2024-10-09

Business Banking

published

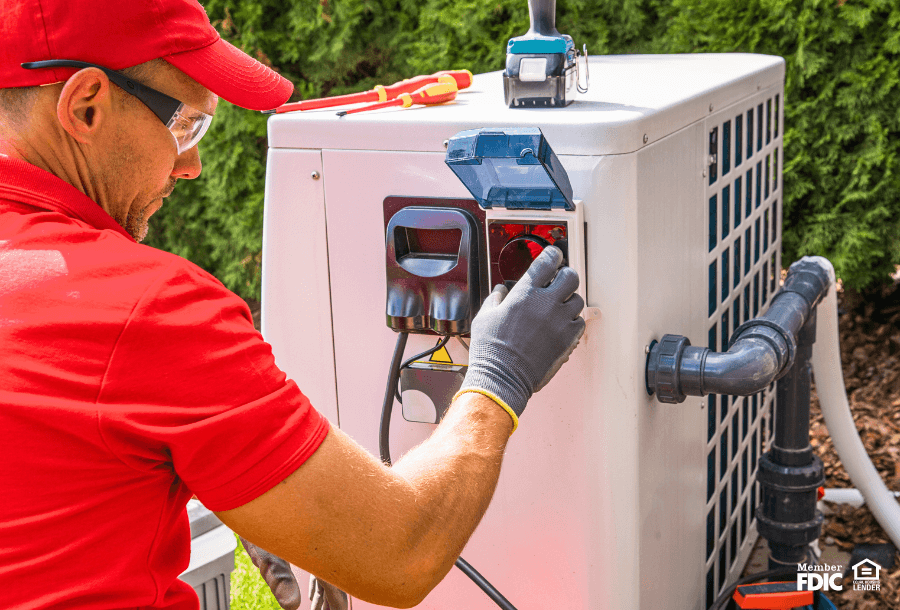

Heating and Cooling: Business Line of Credit for HVAC Companies

-

-

Running an HVAC business isn’t always a breeze. Between managing inventory, dealing with seasonal demand, and keeping up with the latest technology trends, it can feel like you’re constantly juggling a million things. One effective financial solution? A line of credit for business. Whether you are a small business owner, an industry professional, or a seasoned HVAC business owner, you’re in the right place! Here's why companies in the heating and cooling industry should consider applying for a business line of credit.

HVAC Industry Trends Today:

The heating and cooling industry is evolving rapidly. Here are some key trends responsible for driving this change:

- Customer Spending Trends — Inflation has hit homeowners hard, reducing spending on residential HVAC. Yet, 97% of new single-family homes in the U.S. still have air conditioners, offering opportunities for service contracts.

- Tax Incentives — The U.S. Inflation Reduction Act is offering tax credits to homeowners who install energy-efficient HVAC systems, making it the perfect time to promote energy-saving products.

- Commercial Growth — The commercial sector is booming, with a 7% growth rate expected from 2023 to 2030. More commercial spaces mean more HVAC installations and maintenance.

- Smart Technology — The demand for smart thermostats and geothermal systems is on the rise. Millennials are leading the charge, with 77% investing in smart HVAC technology.

- Pricing Trends —While supply chain issues have eased, new regulations on HFC refrigerants and SEER2 standards are pushing up equipment prices.

- Labor Market — The HVAC workforce is in flux, with many workers retiring or moving to different fields. Yet, Gen Z shows a strong interest in vocational training, which could help fill the gap.

- Software Integration — More heating and cooling businesses are adopting software solutions to streamline operations, from job scheduling to client relationship management.

What is a Business Line of Credit?

In the world of business banking, a line of credit is a flexible way for companies to borrow money when they need it—up to a set limit. Instead of receiving a lump sum like a traditional business loan, the organization can withdraw funds as needed and only pay interest on what they use. This structure is often called “revolving credit” because it allows businesses to borrow, repay, and borrow again. This type of financing is great for managing cash flow, covering short-term expenses, or handling unexpected costs.

To review the basics of business lines of credit, check out our previous article What is a Business Line of Credit and How Does It Work?

How HVAC Companies Can Use a Business Line of Credit:

Based on the market trends in the heating and cooling industry, HVAC businesses need a financial solution to address their challenges and equip them for future success. Here’s how using a line of business credit can help:

1. Managing Inventory

Keeping up with the latest HVAC trends requires a well-stocked inventory. Whether it’s energy-efficient systems, smart thermostats, or the newest air purification technologies, having the right products on hand is crucial, especially if you want to stay competitive and meet customer demands. A business line of credit ensures you can purchase inventory without straining your cash flow. When you invest in a diverse and up-to-date inventory, it not only attracts more customers but also positions your business as a leader in the HVAC industry.

2. Navigating Seasonality

The heating and cooling industry is notoriously seasonal, experiencing peak demand during the cold winter months and hot summer days. A line of business credit helps you manage cash flow during slower periods, making sure you can cover operational expenses like employee salaries and utility bills. Having a dedicated business bank account allows you to track your income and expenses more effectively, giving you a clearer picture of your financial health during these fluctuating times.

3. Investing in Technology

Staying competitive means investing in the latest technology, from smart thermostats to advanced diagnostic tools. These can boost your operational efficiency. A business line of credit can provide the funds needed to keep your business at the forefront of innovation and success.

4. Supporting Maintenance Services

Regular maintenance is essential for ensuring customer retention and generating steady revenue. By financing parts, tools. and skilled personnel through a line of credit, you can expand your service offerings without depleting your cash reserves. This approach boosts your ability to operate and sets your business up for long-term growth.

5. Leveraging Tax Incentives

Take advantage of new tax incentives by stocking up on energy-efficient heating and cooling systems. A business line of credit provides the upfront capital needed to make these purchases, allowing you to pass the savings on to your customers.

6. Expanding Your Business

Are you considering expanding into new markets or taking on larger projects? A line of credit offers the financial flexibility needed to seize these opportunities without worrying about immediate cash flow concerns. By having access to additional funds, businesses can invest in their future, explore new ventures, and capitalize on emerging trends—all while maintaining smooth operations.

7. Training and Hiring

With the HVAC labor market in flux, it's crucial to invest in training and hiring to stay competitive and meet industry demands. Consider using a business line of credit to fund comprehensive vocational training programs for new hires, ensuring they gain the necessary skills. Also, focus on helping your current team develop new skills to keep up with changing technologies and techniques. This broadens their expertise and contributes to your business's future potential.

8. Handling Emergency Repairs

Unexpected repairs can throw a wrench in your budget, causing stress and potentially halting operations. However, with a line of credit for business, you have access to funds for emergency repairs. This ensures your company experiences minimal disruption so your operations can continue efficiently.

Choose the Best Business Line of Credit in the Heating and Cooling Industry

In an industry with rapid changes and shifting demand, a business line of credit offers HVAC companies the flexibility and security they need to thrive. This financial tool helps companies handle seasonal challenges, seize industry trends, and invest in their future.

By integrating a line of business credit into your financial strategy, you’re not just keeping the lights on—you’re setting your business up for long-term success. Wondering how to get a business line of credit? Academy Bank offers flexible options tailored to meet the unique needs of heating and cooling companies, just like yours!

Don’t wait for the next peak season or supply chain hurdle to get started. Reach out to our business bankers today and see how a business line of credit can transform your HVAC business.

Apply for a Business Line of Credit.

Do you already have a line of credit for business? You can make a payment strategy with a Line of Credit Payoff Calculator!

Member FDIC

All business loans and lines of credit are subject to credit approval and require automatic payment deduction from an Academy Bank business checking account. Origination and annual fees may apply.