Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2025-02-13

Credit

published

3-minute

Scoring Models: How to Calculate FICO Score

-

-

Your credit score is a BIG DEAL in personal finance. For example, it can determine whether you get approved (or denied) for car loans, credit card perks, or apartment rentals. “FICO scores” are one of the most popular credit scoring models, but they are frequently misunderstood or lumped together with other scoring systems. So what is the difference? Keep reading! This guide will walk you through the basics of FICO scores, how they are calculated, and how to use secured credit cards to help your financial standing.

What is a FICO Score?

A FICO score is a type of credit score that measures your creditworthiness. Lenders—such as banks, credit card companies, and auto loan providers—use your FICO score to assess how likely you are to repay what you borrow.

Though often used interchangeably with “credit score,” the FICO score is actually just one type of credit score. Other scoring models, like VantageScore, also exist, but FICO is the industry standard used by over 90% of top lenders.

FICO scores range from 300 to 850, with higher scores reflecting better creditworthiness:

- 300 - 579: Poor

- 580 - 669: Fair

- 670 - 739: Good

- 740 - 799: Very Good

- 800 - 850: Exceptional

Understanding your FICO score gives you a clearer picture of how lenders interpret your financial standing.

How are FICO Scores Determined?

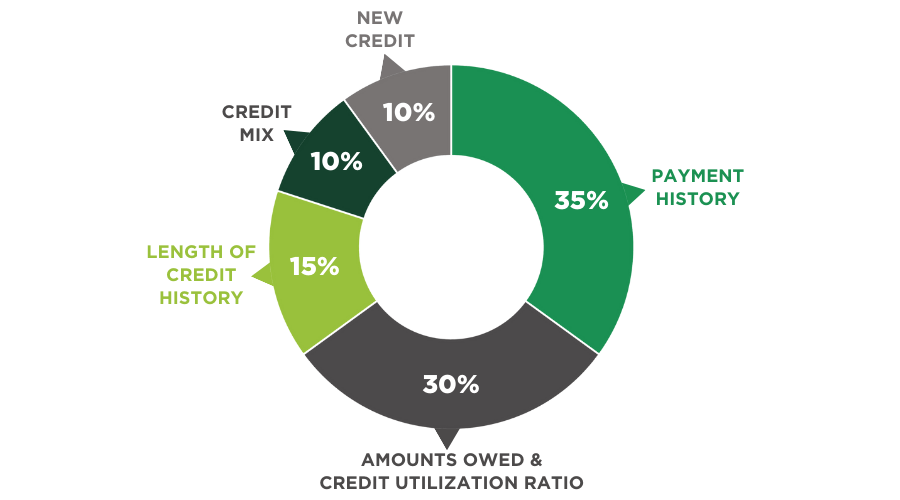

Your FICO score is calculated using five key factors, each weighing differently on your overall score. Here’s what each factor means and how they affect your credit profile and score:

1. Payment History (35% of FICO Score)

Your payment history has the largest impact on your FICO score. Lenders want to see if you consistently pay your loans or credit card bills on time—because if you don’t, why would they risk lending you money?

- Why Payment History Matters: A solid record of on-time payments builds trust with lenders. On the flip side, late payments, defaults, or accounts sent to collections will harm your score.

- Payment History Pro Tip: While paying your bills in full is preferred, always make sure to pay at least the minimum on time! We suggest setting up reminders or auto-pay, so you never miss a deadline!

2. Credit Utilization (30% of FICO Score)

Credit utilization refers to the percentage of your available credit that you are currently using. For example, if you have a $10,000 credit limit and a $3,000 balance, your utilization ratio is 30%.

- Why Credit Utilization Matters: A lower utilization ratio shows lenders that you manage credit responsibly without overspending.

- Credit Utilization Pro Tip: Aim to keep your credit utilization below 30%. Paying off your balance more frequently or increasing your credit limit can make it easier to stay within this range.

3. Length of Credit History (15% of FICO Score)

This factor evaluates how long your credit accounts have been open. Specifically, your credit history includes the age of your oldest account, the age of your newest account, and average age of all your accounts. The longer, the better—especially when paired with a history of on-time payments.

- Why Credit History Matters: A long credit history signals stability and experience with handling credit over time.

- Credit History Pro Tip: Avoid opening or closing accounts too frequently (it can reduce the average age of your credit history).

4. Credit Mix (10% of FICO Score)

Your FICO score benefits from a variety of credit types, such as credit cards, auto loans, and mortgages. That’s because lenders like seeing you can manage different kinds of credit responsibly.

- Why Credit Mix Matters: A mix of revolving credit (like credit cards) and installment credit (like personal loans) shows you are well-rounded in managing debt.

- Credit Mix Pro Tip: Don't take out new loans just to diversify your credit mix. Instead, let it develop naturally as your financial needs change.

5. New Credit (10% of FICO Score)

Opening new credit accounts or applying for multiple lines of credit in a short span can temporarily lower your FICO score. This is because each application triggers a "hard inquiry," which is recorded on your credit report.

- Why New Credit Matters: Too many hard inquiries suggest risky financial behavior, like desperation for money.

- New Credit Pro Tip: Space out credit applications and only apply for new lines of credit when absolutely necessary.

How Do You Build Credit with a Secured Credit Card?

Improving your FICO score doesn’t happen overnight. So, if you are wondering where to start, the best choice is applying for a secured credit card for an extra boost. A secured credit card is like a regular credit card, but it requires a security deposit, which determines your credit limit. The security deposit also reduces risk for lenders, meaning it’s easier to qualify for this card even if you have less-than-perfect credit.

At Academy Bank, we’re proud to offer the Credit Builder Secured Credit Card, which is one of the best credit cards for building credit.

Card Features:

- No Application Fee, Over-Limit Fees, or Annual Fees.

- Reports to Major Credit Bureaus to help build your credit history.

- Customizable Credit Limits from $300 to $3,000, based on your deposit.

- Ability to Upgrade to an Unsecured Card with good payment performance.

By using your Credit Builder Card responsibly, you can build better credit and improve your FICO score. It’s an easy way to strengthen your financial standing without barriers. Take control of your credit journey, and get started today!

Apply for a Credit Builder Secured Card

Have questions about getting started? Explore our Credit Assessment Calculator and other resources to get a clear picture of your finances.

Subject to credit approval. Transaction and Penalty fees apply. Credit Builder Savings Account required. $5.00 quarterly fee charged to the Credit Builder Savings Account if not enrolled in eStatements. Improved credit score is not guaranteed. Credit score is determined by credit reporting agencies based on multiple factors, but satisfactory performance on a credit card product can improve your credit score. Default on a credit card, including missed or late payments can damage your credit score. Once added, funds cannot be withdrawn from the Credit Builder Savings Account and the Credit Builder Secured Credit Card without closing the savings account and the credit card.

.png)